Incorporating a business in Colorado offers numerous advantages, from legal protection to enhanced credibility. This guide will walk you through the process of how to incorporate in Colorado, covering everything from choosing a business structure to filing the necessary paperwork. Let’s dive in and explore the vibrant landscape of Colorado’s business world. how to start a nonprofit in colorado

Choosing the Right Business Structure for Your Colorado Venture

The first step in incorporating in Colorado is selecting the best business structure for your needs. Common options include Limited Liability Companies (LLCs), S Corporations, and C Corporations. Each structure has its own advantages and disadvantages concerning taxation, liability, and administrative requirements.

- Limited Liability Company (LLC): Offers personal liability protection and flexible tax options. This is a popular choice for small businesses.

- S Corporation: Combines the benefits of a corporation with pass-through taxation, avoiding double taxation.

- C Corporation: Offers the strongest liability protection but is subject to double taxation. This structure is often preferred by larger companies.

Navigating the Incorporation Process in Colorado

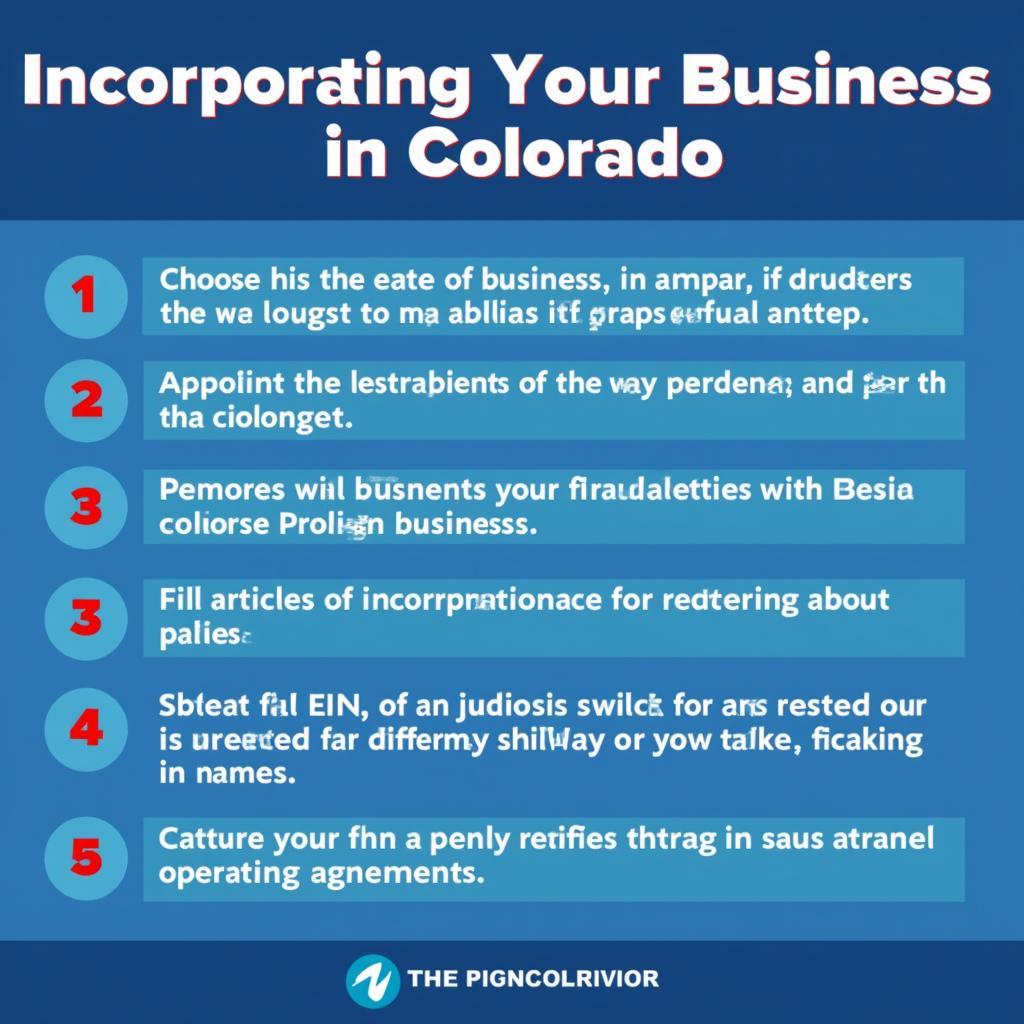

Once you’ve chosen your business structure, you can begin the incorporation process. This involves several key steps:

- Choose a Business Name: Your name must be unique and distinguishable from other registered businesses in Colorado.

- Appoint a Registered Agent: A registered agent is a person or entity authorized to receive legal and official documents on behalf of your business.

- File Articles of Incorporation: This document outlines your business’s purpose, structure, and other essential information. It must be filed with the Colorado Secretary of State.

- Obtain an EIN: An Employer Identification Number (EIN) is required for businesses with employees and is used for tax purposes.

- Create Operating Agreements (for LLCs): This document outlines the internal operations and management structure of your LLC.

Step-by-Step Guide to Incorporating Your Business in Colorado

Step-by-Step Guide to Incorporating Your Business in Colorado

Benefits of Incorporating in Colorado

Colorado offers a supportive environment for businesses, with several advantages for incorporated entities. These benefits include:

- Limited Liability: Protects your personal assets from business debts and lawsuits.

- Credibility and Professionalism: Incorporating can enhance your business’s image and build trust with customers and partners.

- Tax Advantages: Depending on your chosen structure, you may qualify for various tax deductions and credits.

- Access to Capital: Incorporated businesses may find it easier to secure funding from investors and lenders.

Will the location of your business impact the process? It won’t change the incorporation steps, but choosing the right location for your business within Colorado is still essential. me spa lakewood colorado demonstrates the importance of location in a business’s success.

Common Mistakes to Avoid When Incorporating in Colorado

Incorporating can be complex, and it’s crucial to avoid common pitfalls. Here are a few to watch out for:

- Failing to understand the different business structures: Take the time to research and choose the structure that best suits your needs.

- Not complying with state regulations: Ensure you follow all the required steps and file the necessary paperwork correctly.

- Neglecting to create operating agreements (for LLCs): This can lead to disputes and confusion down the line.

“Thorough planning and understanding of the incorporation process are essential for a smooth and successful launch in Colorado,” advises Sarah Miller, a business consultant with over 15 years of experience helping entrepreneurs navigate the complexities of incorporating in the state.

Conclusion

Incorporating in Colorado is a significant step for any business. By understanding the process and choosing the right structure, you can set your business up for success. Remember to research thoroughly, comply with all regulations, and seek professional advice when needed. This ensures your Colorado incorporation journey is smooth and efficient.

FAQ

- How long does it take to incorporate in Colorado? The processing time can vary but generally takes a few weeks.

- What is the cost of incorporating in Colorado? The fees vary depending on the business structure and other factors.

- Do I need an attorney to incorporate in Colorado? While not mandatory, it’s highly recommended to seek legal counsel.

- Where do I file the articles of incorporation? These are filed with the Colorado Secretary of State.

- Can I change my business structure after incorporating? Yes, it’s possible to convert to a different structure later.

- What are the ongoing requirements for maintaining an incorporated business in Colorado? This includes annual reports and other filings.

- Where can I find more information about incorporating in Colorado? The Colorado Secretary of State’s website is a valuable resource. will rogers shrine colorado

You might also be interested in learning about other aspects of doing business in Colorado. Check out our articles on when was the last total solar eclipse in colorado and is essex county colorado real.

Need help with incorporating your business in Colorado? Contact us today! Phone: 0373298888, Email: [email protected], or visit our office at 86 Cầu Giấy, Hà Nội. Our team is available 24/7 to assist you.