Understanding who gets Tabor refunds in Colorado can be confusing. This article will break down the complexities of the Taxpayer’s Bill of Rights (TABOR) and explain who is eligible for these refunds, how they are calculated, and what you can expect.

Decoding Colorado’s TABOR and its Impact on Refunds

Colorado’s TABOR, enacted in 1992, limits the amount of revenue the state can collect and spend. When revenue exceeds this limit, the excess is refunded to taxpayers. This mechanism is a cornerstone of Colorado’s fiscal policy and has significant implications for both the state budget and individual taxpayers.

Understanding the TABOR Surplus Calculation

The TABOR surplus is calculated based on a complex formula that considers population growth and inflation. When revenue surpasses the calculated limit, the excess is deemed a surplus and triggers the refund process. This process ensures that the state government adheres to the spending limits imposed by TABOR.

TABOR Surplus Calculation Diagram

TABOR Surplus Calculation Diagram

Who Qualifies for a TABOR Refund?

Generally, anyone who filed a Colorado state income tax return for the applicable year is eligible for a TABOR refund. This includes full-year residents, part-year residents, and even those who only earned income in Colorado for a portion of the year.

Specific Eligibility Requirements:

- Filed a Colorado State Income Tax Return: You must have filed a Colorado state income tax return for the year the surplus occurred.

- Colorado Resident: You must have been a Colorado resident, either full-time or part-time, during the applicable tax year.

How TABOR Refunds Are Distributed

TABOR refunds are typically distributed in one of several ways, depending on the legislation passed for that specific refund. Methods include:

- Equal Refunds: Every eligible taxpayer receives the same amount, regardless of income.

- Income-Based Refunds: The refund amount varies based on the taxpayer’s income.

- Tax Credits: Refunds can be applied as credits against future tax liabilities.

- Sales Tax Refunds: Refunds might be distributed through a temporary reduction in sales tax.

Understanding Recent TABOR Refund Distributions

Recent TABOR refunds have often been distributed as equal payments to eligible taxpayers. However, the specific method of distribution can vary, so it’s essential to stay updated on the latest information from the Colorado Department of Revenue.

“Understanding how TABOR refunds are calculated and distributed is crucial for Colorado residents,” says John Davis, CPA and tax expert at Denver Tax Advisors. “It’s important to stay informed about changes in legislation and distribution methods to ensure you receive your entitled refund.”

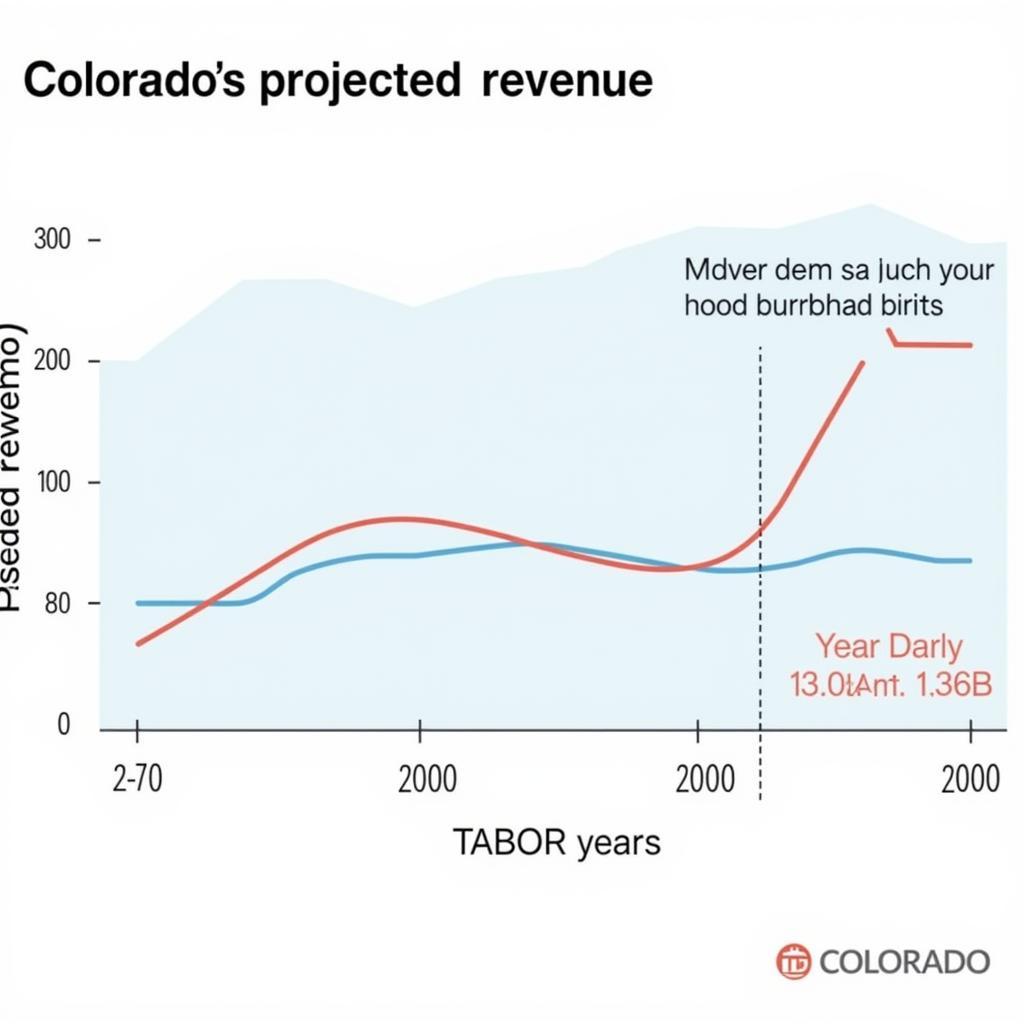

Anticipating Future TABOR Refunds

Predicting future TABOR refunds is challenging due to the fluctuating nature of state revenue and economic conditions. However, by staying informed about Colorado’s economic outlook and monitoring revenue projections, you can gain some insight into the possibility of future refunds.

Colorado Revenue Projection Chart

Colorado Revenue Projection Chart

Conclusion

Navigating the intricacies of TABOR refunds can be complex. By understanding who qualifies, how the surplus is calculated, and the different distribution methods, you can better prepare for and understand your TABOR refund. Stay updated with the latest information from the Colorado Department of Revenue to ensure you receive the refund you are entitled to.

FAQ

- Do I have to apply for a TABOR refund? No, refunds are typically automatic for eligible taxpayers who filed a Colorado state income tax return.

- When are TABOR refunds usually distributed? The timing varies depending on the specific refund legislation.

- What if I didn’t file a tax return in Colorado for the year the surplus occurred? You will likely not be eligible for the refund.

- Where can I find more information about TABOR refunds? The Colorado Department of Revenue website is the best source for updated information.

- How can I estimate the amount of my TABOR refund? The refund amount depends on the total surplus and the chosen distribution method. Check the Colorado Department of Revenue website for specific details.

- Can TABOR refunds be garnished for outstanding debts? This depends on the specific circumstances and the type of debt.

- What happens to TABOR refunds if I’ve moved out of state? You will still be eligible for the refund if you filed a Colorado tax return for the relevant year.

“TABOR refunds are a unique aspect of Colorado’s tax system,” adds Sarah Miller, financial advisor at Rocky Mountain Financial. “Understanding this system can help you better manage your finances and anticipate potential refunds.”

For assistance with TABOR refunds or any other tax-related questions, please contact us: Phone: 0373298888, Email: [email protected] or visit our office at 86 Cau Giay, Hanoi. Our customer service team is available 24/7.